In 2021, the Current Health Expenditure (CHE) in the Philippines rose to PHP 1.09 trillion, 18.5% higher than in 2020, based on the Philippine Statistics Authority (PSA). The CHE is the total amount spent by the government, HMO providers, insurance companies, and out-of-pocket (OOP) for health care.

And 41.5% of which is from the individual pockets of Filipinos.

As a result, we have to address a huge health insurance gap, as it pushes approximately 1.5 million Filipinos into poverty each year. Consequently, it forces families to cut back on education and vital spending.

Hence, insurance companies must work harder to fill this gap. On the other hand, we have seen improvements in out-of-pocket expenditure from 44.7% in 2020. It translates to a slight improvement in the overall health care system in the country.

Table of Contents

Health Insurance Gap

Undeniably, the pandemic shocked the world, especially the medical industry. However, challenges in health care are an existing problem in the country. In other words, the COVID-19 pandemic only amplified the situation.

Many Filipinos died because they cannot access the medical treatment they needed.

While some survive only to face poverty, there’s a great need for life and health insurance, which plays a vital role in nation-building.

The Rising Cost of Getting Sick in the Philippines

In 2017, there were about 4 Million Filipinos who had HMO coverage. In spite of that, the average maximum benefit limit (MBL) is only PHP 150,000.

Although, it is a big help to ailing employees, the limit is very small compared to the average cost of medical treatments.

Furthermore, it is not enough to cover major medical health concerns such as stroke, cancer, heart attack, etc.

It gives a false security blanket, that is enough. But because a stroke costs around Php 1.8 million, it is way beyond the average MBL. Moreover, a heart attack costs Php 900,000, breast cancer at Php 430,000, and lung cancer at Php 2.7 million.

In addition, the difference between the MBL and the actual cost of treatment is what we call the “out-of-pocket.”

Thus, you have two choices when you get ill.

Firstly, cover the medical cost by selling your properties or using your savings, which are intended for other things, such as the education of your kids, building a house, starting a business, etc.

Secondly, transfer the risk to an insurance company by getting life and health insurance.

How do we come up with the list?

Many companies are claiming the number 1 spot as the top life insurer. Moreover, some blogs and websites have decided to consolidate the data from the Insurance Commission (IC). But the question is, “Is this the correct way of digesting the data?”

So don’t worry; this blog is here to help you with the confusion.

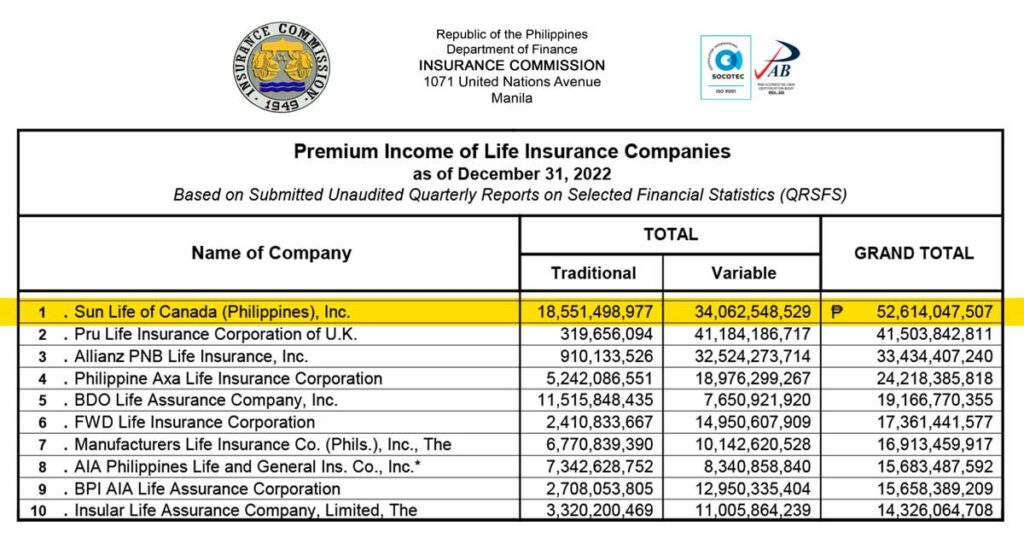

On March 24, 2023, IC released seven (7) financial reports, and different companies topped each metric. But among the seven (7) categories, only one is widely used to come up with the top 10 life insurance companies in the Philippines in 2023. It is not just in the Philippines but the entire world, and that’s “Premium Income.”

Premium Income is the revenue that an insurer receives as premiums paid by its customers for insurance products. When a customer purchases an insurance product, such as a health insurance policy, the customer’s cost for a specified term of the insurance policy is called the premium. (Investopedia)

How to interpret the categories

While premium income is used to determine the top life insurers, the remaining metrics are also important. Hence, they are released by IC for a reason. For instance, you may use it to assess the overall financial health of a company.

You may interpret each category in this way.

Premium Income

It is a combination of the past and present business of the insurance company.

The past business is often called the renewal premiums. And a good percentage of renewals means that clients are happy with the services, so they continue paying for their plans. Furthermore, it means that the company’s business is of high quality.

In addition, the present business is what we call the NBAPE.

New Business Annual Equivalent (NBAPE)

It signifies the sales performance of an insurance company in a given year. Thus, it is vital to acquire new business. That is to say that the new business annual equivalent reflects how the general public perceives a company in a particular year.

Therefore, growth is desirable, while a decline means losing interest or trust.

Net Income

It is equal to the income minus expenses. Thus, it shows how profitable the business is. Because you will be placing your hard-earned money through insurance, so you must consider profitability.

Of course, you want the company to be there when the time comes.

Net worth

It is equal to the assets minus liabilities. Undeniably, it shows the capacity of a company to cover liabilities, such as claims.

Use this to foresee if the company can cover future claims.

Total Assets

It is composed of current and fixed assets. Likewise, here you can see how the company manages its assets. Thus, a good company should have growing assets to support its business and sales.

Sun Life Remains the Top Life Insurance Company in 2023

Sun Life is the number one insurer of 2023, based on the latest performance released by the Insurance Commission on March 24, 2023. Thus, it is the 12th consecutive time that Sun Life managed to top the premium income category both in traditional (whole life, term, and endowment) and variable plans.

So why does being number one (or being part of the top 10) important to you as an insurance buyer?

Because it serves as validation that companies like Sun Life can still fulfill their promise to their clients.

Remember, life insurance is an aleatory or promise contract, meaning that when a specified event occurs, like death, the insurer will have to pay the promised amount.

Of course, you want your family to get the benefits by the time it happens to you, right?

Sun Life’s Traditional and VUL Plans

It’s essential to consider the standing of an insurance company before availing of any insurance plan. You want that by the time the need arises, the company is still performing well to fulfill its obligations to you. But this shouldn’t be your sole basis for getting a plan. Undoubtedly, you might as well consider convenience, customer service, a reputable Financial Advisor, etc.

A VUL plan is perfect if you want income protection with a wealth accumulation plan. It lets you grow your money while giving you financial security and peace of mind. So click the link below to request a quotation and financial consultation.

READ: Sun Maxilink Prime | Best-Selling VUL Plan of Sun Life

Health is wealth. So get the most comprehensive health insurance in the country, covering 114 critical illnesses. Make sure you get the treatment you need when you need it most. So click the link below to learn more.

READ: Sun Fit and Well | Most Comprehensive Health Insurance Plan

*****

Top 10 Life Insurance Companies in the Philippines 2023

Now, let us know more about the other companies that complete the list. As mentioned before, we based the top 10 life insurance companies in the Philippines on premium income. The table below summarizes the overall performance of each company.

| Insurance Company | Premium Income | NBAPE | Net Income | Net Worth | Total Assets |

|---|---|---|---|---|---|

| Sun Life | 1 | 1 | 1 | 3 | 1 |

| Pru Life UK | 2 | 2 | 9 | 10 | 5 |

| Allianz PNB Life | 3 | 3 | 28 | 19 | 8 |

| AXA | 4 | 5 | 5 | 6 | 3 |

| BDO Life | 5 | 4 | 4 | 4 | 9 |

| FWD | 6 | 6 | 17 | 11 | 12 |

| Manulife | 7 | 7 | 7 | 5 | 6 |

| AIA Philippines | 8 | 16 | 2 | 1 | 2 |

| BPI-AIA | 9 | 8 | 6 | 7 | 7 |

| Insular Life | 10 | 9 | 3 | 2 | 4 |

So here are the top 10 life insurance companies in the Philippines in 2023.

1. Sun Life of Canada (Philippines) Inc.

Officially founded in 1895, Sun Life of Canada (Philippines) is the first and oldest life insurance company in the Philippines. Undeniably, the ability to fulfill its promises to its clients has made Sun Life the preferred life insurance company in most households. No wonder it is still the top life insurance company in the country.

READ: Sun Life | A Company that Loves to Pay Claims

➡ Premium Income: 1

⬆ NBAPE: 1

⬆ Net Income: 1

➡ Net Worth: 3

➡ Total Assets: 1

Sun Life remained the number 1 life insurance company in the Philippines in 2023 for 12 consecutive years based on Premium Income.

They also regained the number 1 spot in terms of NBAPE from Pru Life with a wider margin of Php 255 million. This is due to the collective effort of insurance agents to provide better financial opportunities to every household.

This year is a triple victory for the company, as it was able to snatch first place in the net income category as it overtook AIA.

READ: Sun Maxilink Prime | Best-Selling VUL Plan of Sun Life

2. Pru Life Insurance Corp. of UK.

The company started in 1996, 27 years in the life insurance industry in the Philippines. Despite being relatively new compared to its rivals, Pru Life UK bagged 2nd place in the list.

⬆ Premium Income: 2

⬇ NBAPE: 2

⬇ Net Income: 9

➡ Net Worth: 10

➡ Total Assets: 5

Pru Life has led in NBAPE for two years since the COVID-19 pandemic started. But it ended this year as they slipped down to the second spot.

However, Pru Life was not able to improve its position in Net Worth and Total Assets. In addition, there was also a noticeable decline in its net income as it slipped further to the 9th spot.

3. Allianz PNB Life Insurance, Inc.

Allianz PNB Life was founded in 2001, operating as a subsidiary of Alliance SE. The company is in 3rd place in the top 10 life insurance companies in the Philippines 2023. This is a step forward compared to last year.

⬆ Premium Income: 3

⬆ NBAPE: 3

⬇ Net Income: 28

➡ Net Worth: 19

⬆ Total Assets: 8

Truly, Allianz PNB’s business is a game-changer this year. It made advances in premium income by one (1) place, one (1) in NBAPE, and one (1) in total assets. However, net income plummets to 28th place, which may be due to aggressive business expansion.

4. Philippine AXA Life Insurance, Corp.

AXA Philippines was only established in 1999 in the Philippines but has shown massive growth and market penetration thanks to its bancassurance business. In fact, it is a joint venture between AXA Group and Metrobank Group.

⬇ Premium Income: 4

⬇ NBAPE: 5

➡ Net Income: 5

⬆ Net Worth: 6

➡ Total Assets: 3

Indeed, the company is stable and has maintained its position in net income and total assets. In addition, there is an increase in net worth. Despite being a stable company, it almost didn’t grow in acquiring new business as it continued to slide down by two (2) places in premium income and NBAPE.

5. BDO Life Assurance Co. Inc.

Founded in 1999 as a joint venture between Generali Pilipinas Holdings Company Inc. (GPHC) and BDO. But now, BDO Life Assurance Co. Inc is the new name of Generali.

⬆ Premium Income: 5

⬆ NBAPE: 4

⬆ Net Income: 4

⬆ Net Worth: 4

⬇ Total Assets: 9

Additionally, BDO Life has now coped with the pandemic as they advance by one (1) place in terms of premium income, NBAPE, and net worth. Then the company moves from 7th place to 4th place in terms of its net income. However, it dropped to 9th place in terms of total assets.

6. FWD Life Insurance Corporation

In 2014, FWD started in the Philippines. Despite being a relatively new player in the industry, they manage to be in the top 10 life insurance companies in the Philippines.

⬇ Premium Income: 6

➡ NBAPE: 6

⬇ Net Income: 17

➡ Net Worth: 11

➡ Total Assets: 12

Due to the easing of travel restrictions, most insurance companies continue to expand. With a more competitive environment, FWD drops by one (1) place in premium income and seven (7) places in net income. However, there are no changes in NBAPE, net worth, or assets.

7. Manulife Philippines

Manufacturers Life Ins. Co. (Phils.) or just Manulife, is a wholly-owned subsidiary of The Manufacturers Life Insurance Company. It was then established in 1907, making it one of the oldest insurance companies in the Philippines.

⬆ Premium Income: 7

⬆ NBAPE: 7

⬇ Net Income: 7

⬇ Net Worth: 5

➡ Total Assets: 6

Manulife advances by one (1) place in premium income and NBAPE. But due to expansion, there is a decline in net income and net worth. However, there is no change in its total assets.

8. AIA Philippines

AIA Philippines, formerly Philam Life, was founded in 1947 by Cornelius Vander Starr and partner Earl Carrol. Undoubtedly, their incredible partnership made Philam Life the number 1 life insurance company in the business in 1949.

⬆ Premium Income: 8

⬇ NBAPE: 16

⬇ Net Income: 2

➡ Net Worth: 1

➡ Total Assets: 2

AIA Philippines climbs two (2) places in premium income. However, there’s a steep decline in NBAPE by six (6) while it maintains its spot in net worth. In addition, this year, Sun Life was able to snatch the number one (1) place in net income. While there are no changes in net worth or total assets,

9. BPI-AIA Life Assurance Corporation

Previously known as Ayala Life Assurance Incorporated, it was founded in 1933. It is the country’s top bancassurance on the list thanks to the strategic alliance between BPI and Philam Life.

⬇ Premium Income: 9

⬇ NBAPE: 8

➡ Net Income: 6

⬇ Net Worth: 7

➡ Total Assets: 7

BPI-AIA is not having a great start after the easing of travel restrictions. It continues to drop in premium income, NBAPE, and net worth.

10. Insular Life Assurance Company, Ltd.

Insular Life is the first Filipino-owned life insurance company in the Philippines, founded in 1910. It is a mutual company, which means its policyholders own it.

Premium Income: 10

NBAPE: 9

Net Income: 3

Net Worth: 2

Total Assets: 4

Insular Life has made a comeback in the top 10 life insurance companies in the Philippines after slipping during the pandemic. Undeniably, the company has strong financial standing, as they come third in net income, second in net worth, and fourth in total assets.

Top 10 Life Insurance Companies in the Philippines (NBAPE) 2023

Getting more clients means generating more income for business expansion and the payment of claims. It can also lower administrative and insurance charges, resulting in more allocation in the investment fund of your VUL plan or dividends for a traditional insurance plan.

Sun Life of Canada (Phil) Inc. has made a successful comeback as the front-runner in new business premiums after two years. On the other hand, Pru Life was not able to sustain the lead. Hence, they are pushed to the second spot.

You may refer to the table below for a more comprehensive look at the performance of each life insurance company in 2022.

| Insurance Company | NBAPE |

|---|---|

| Sun Life of Canada (Philippines), Inc. | P9,715,517,258 |

| Pru Life Insurance Corp. of U.K. | P9,460,349,346 |

| Allianz PNB Life Insurance, Inc. | P4,734,817,287 |

| BDO Life Assurance Company, Inc. | P3,895,000,058 |

| Philippine AXA Life Insurance Corporation | P3,465,634,387 |

| FWD Life Insurance Corporation | P3,304,971,357 |

| Manufacturers Life Insurance Co. (Phils.), Inc., The | P2,934,828,925 |

| BPI AIA Life Assurance Corporation | P2,396,541,343 |

| Insular Life Assurance Company, Limited, The | P1,998,001,807 |

| Manulife Chinabank Life Assurance Corporation | P1,713,358,447 |

Top 10 Life Insurance Companies in the Philippines Based on Net Income 2023

In a nutshell, net income is the total profit of a company after subtracting all the expenses in operating a business. Accordingly, Sun Life of Canada (Phil) Inc. has reclaimed the top spot from AIA Philippines for this year.

| Insurance Company | Net Income |

|---|---|

| Sun Life of Canada (Philippines), Inc. | P11,731,682,730 |

| AIA Philippines Life and General Ins. Co., Inc. | P6,312,959,073 |

| Insular Life Assce. Co., Ltd., | P3,961,087,909 |

| BDO Life Assurance Company, Inc. | P3,570,130,566 |

| Philippine AXA Life Insurance. Corp | P2,461,297,245 |

| BPI-AIA Philippines Life Assurance Corporation | P1,515,641,360 |

| Manufacturers Life Insurance Company (Phils.), Inc., The | P1,494,970,790 |

| Sun Life Grepa Financial, Inc. | P1,189,878,187 |

| Pru Life Insurance Corporation of U.K. | P1,015,555,286 |

| Manulife Chinabank Life Assurance Corporation | P732,640,710 |

Top 10 Life Insurance Companies in the Philippines Based on Net Worth 2023

Philam Life remained the number 1 spot in the net worth category, or the amount by which the assets exceeded their liabilities, followed by Insular Life, Sun Life, and BDO Life.

| Insurance Company | Net Worth |

|---|---|

| AIA Philippines American Life and General Ins. Co., Inc. | P67,975,326,716 |

| Insular Life Assce. Co., Ltd., The | P49,389,095,332 |

| Sun Life of Canada (Philippines), Inc | P41,786,869,466 |

| BDO Life Assurance Company Inc. | P17,153,691,388 |

| Manufacturers Life Ins. Co. (Phils.), Inc., The | P13,227,198,219 |

| Philippine AXA Life Insurance. Corp | P9,304,187,079 |

| BPI-AIA Life Assurance Corporation | P7,175,245,738 |

| Sun Life GREPA Financial, Inc. BDO Life Assurance Company, Inc. | P5,747,881,985 |

| United Coconut Planters Life Assce. Corp | P5,575,303,259 |

| Pru Life Insurance Corp. of U.K. | P4,042,308,736 |

Top 10 Life Insurance Companies in the Philippines Based on Assets 2023

An asset is anything expected to bring future benefits by generating cash flow, reducing expenses, increasing sales, etc. Sun Life maintained the lead in total assets for the second consecutive year.

| Insurance Company | Total Assets |

|---|---|

| Sun Life of Canada (Philippines), Inc. | P278,057,265,750 |

| AIA Philippines American Life and General Ins. Co., Inc. | P257,649,945,812 |

| Philippine AXA Life Insurance. Corp | P146,350,488,204 |

| Insular Life Assce. Co., Ltd., The | P144,592,028,451 |

| Pru Life Insurance Corp. of U.K. | P127,825,757,254 |

| Manufacturers Life Ins. Co. (Phils.), Inc., The | P113,189,300,124 |

| BPI-AIA Life Assurance Corporation | P109,250,600,440 |

| Allianz PNB Life Insurance, Inc. | P91,230,763,324 |

| BDO Life Assurance Company, Inc. | P90,323,898,355 |

| Manulife Chinabank Life Assurance Corporation | P61,390,067,962 |

RELATED: Sun Maxilink Prime | Best-Selling VUL Plan of Sun Life

How Do You Pick the Right Life Insurance?

Looking for the right insurance plan as a first-time insurance buyer is such a daunting task. Don’t worry. It is okay.

Everyone started somewhere. And after getting your first insurance, choosing the next plans is much easier.

But for now, you may follow the steps below to find the “right” plan for you.

5 Steps in Getting the Right Insurance Plan

1. Choose 5 insurance companies

Firstly, determine what qualities you are looking for, like positive customer service, financial standing, and competitive pricing, and narrow your choices by picking three (3) to five (5) companies from the top 10.

But be careful here, because when we say price, the cheapest isn’t always the best insurance.

So look at the value first before its price.

2. Know what’s important for you

Let me ask you, “What are your top 5 priorities?” Before getting those proposals, you must understand yourself first. So don’t be like the one who just got an insurance plan without a goal.

It is your family that you want to protect from financial struggles.

Nowadays, the rapidly increasing cost of medical care is a concern.

Maybe you want to secure your kids’ future by providing the best education and a roof over their heads.

Likewise, some people think about retirement or what to do as a retiree. Perhaps open a business to keep you busy?

So make sure to reflect on how important this decision is for you. But again, I’ll tell you that getting insurance is a long-term commitment.

Problems will shake you from time to time. Consequently, you might surrender the plan without a clear purpose for why you started. Of course, I know you don’t want to waste your time and money.

Thus, set your goals at this point.

3. Schedule an Appointment

Get in touch with an advisor in each company and set up a meeting with them.

It is for your future, so do not just browse the pages of the proposals you get as if you are browsing a menu; you are not in a restaurant.

Life insurance is for your future, so take time to have a sit-down discussion.

Here are some qualities to look for in an advisor:

- He must be reachable. Can you contact your advisor in times of need? An advisor should be around to check your account and do regular policy updates. For instance, there are times when you’ll forget your coverage and may need a refresher on your plan. So refrain from getting an advisor you are intimidated to ask.

- Is he knowledgeable? Can he explain the plans and options well? Also, you might have heard somewhere to read the fine print of an insurance plan. Yes, you need to know the pros and cons of it, but a knowledgeable advisor will always lay it down without reservation. Because he is not just after the sale but genuinely cares for you.

- Dependable person. Remember that you will be getting not just an insurance plan but also a partner. Thus, consider your insurance plan as your contingency plan that concerns your family’s future. Do you think he is still with the insurance company when your need arises?

Choosing the right advisor is as hard as picking the most suitable insurance plan. In addition, an insurance plan is like proof of how much you care for your family. But on the flip side, an advisor is your partner, or, let’s say, the caretaker of that proof. So be mindful of considering a reachable, knowledgeable, and dependable advisor.

4. Prepare questions

At this point, you may now prepare for questions that concern you the most. But then you don’t have to compute for each fee/charge every year. Do you have to know the production cost of the bag of chips you buy? I don’t think so.

In step 3, you have set your goals. Price should not be the basis, but its value proposition.

Your advisor will answer all your questions during the product presentation.

Thus, ask if you have any remaining questions.

Again, this is for your future, so make sure the plan answers your needs.

5. Finalize your decision

Now that you have met the five (5) advisors and reviewed their proposed plan, at this point, you may create a table or list of things you need and want from an insurance plan versus the proposals.

So which among them is the fittest to your goal?

While some riders or benefits are good additions, remove them if they don’t fit your cause. Just get what you need accordingly.

I hope this blog helped you get the “right” insurance plan.

Cheers!

READ: Sun Fit and Well | Most Comprehensive Health Insurance

*****

References:

- de Vera, Ben O. (2021, April 20). Insurer profit down 8.6 percent in 2020 as pandemic hammers markets. Inquirer.net. Retrieved May 29, 2021, from https://business.inquirer.net/322053/insurer-profit-down-8-6-percent-in-2020-as-pandemic-hammers-markets

- Funa, Dennis B. (2019, June 19). The health insurance gap in the Philippines. Business Mirror. Retrieved May 29, 2021, from https://businessmirror.com.ph/2019/06/19/the-health-insurance-gap-in-the-philippines/

- Mapa, Dennis S. (2020, October 15). Health Spending Grew by 10.9 Percent in 2019. PSA. Retrieved May 29, 2021, from https://psa.gov.ph/content/health-spending-grew-109-percent-2019

- Mapa, Dennis S. (2022, October 13). Health Spending Registered 18.5 Percent Growth, Share of Health to Economy Went Up to 6.0 Percent in 2021, from https://psa.gov.ph/statistics/pnha

- Tan, Arlyn. (2021, April 28). [Fin Talk] Life Insurance Company Ranking: What’s in it for the Policyholders and Beneficiaries?. Now You Know. Retrieved May 29, 2021, from https://www.nowyouknowph.com/post/fin-talk-life-insurance-company-ranking-what-s-in-it-for-the-policyholders-and-beneficiaries?

Ton is an electronics engineer, financial blogger, insurance agent, and a certified investment solicitor. A multi-awarded financial advisor with clients ranging from lawyers, doctors, engineers, accountants, business owners, company directors, and OFWs to minimum wage earners had sought advice from him in achieving lifetime financial freedom.